RetirementGuard helps people keep their money safe.

We specialize in obtaining insurance for physical and cognitive loss.

Our Mission is to help people maintain their dignity in the midst of catastrophic disabling events ... Because of our strategic and singular focus, we can provide a level of sophistication and expertise that might be difficult to match.

Why work with us?

Decades of experience and an outstanding reputation in the industry.

RetirementGuard provides services for brokers and consultants—and we also work directly with employer groups. Our clients include highly regarded universities and health care institutions.

We are primarily technology driven. What differentiates RetirementGuard is that we create warm touch technology. From a benefit communication and enrollment perspective, warm touch enables us to cut through messaging clutter. We are successful in providing different avenues for our messaging to be received, absorbed, and acted upon, which results in higher voluntary plan participation and appreciation.

Resources we find interesting

-

The big issue no one

wants to talk aboutThough most people don't want to talk about needing extended care, the statistics are compelling.

-more- -

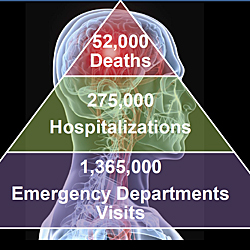

Reducing Severe Traumatic Brain Injury in the United States

43% of hospitalized TBI survivors suffer career ending disabilities. A sobering detailed report from the Centers for Disease Control (CDC)

www.cdc.gov -

Leveling the Playing Field

Outstanding study on the interplay between disability and the workplace—and best practices to accommodate the disabled.

From the Conference Board -

Center for Gerontology and Health Care Research—Brown University

Gerontology/Long-Term Care think tank. Amazingly detailed and (sometimes) fascinating research.

-

Employment and Disability Institute

Wonderful "think tank" on employment/disability issues at Cornell University..

Cornell University ILR School Employment and Disability Institute